Thanks to Trail friend BiD for sharing this with us last night, a good idea that’s found its time:

Sanders-Warren plan would tax the rich to increase Social Security by $2,400 a year | Salon.com

The Social Security Expansion Act, introduced by Sanders, I-Vt., and Warren, D-Mass., in the Senate and by Reps. Jan Schakowsky, D-Ill., and Val Hoyle, D-Ore., in the House, would put an additional $2,400 in beneficiaries’ pockets each year and ensure the program is fully funded through 2096.

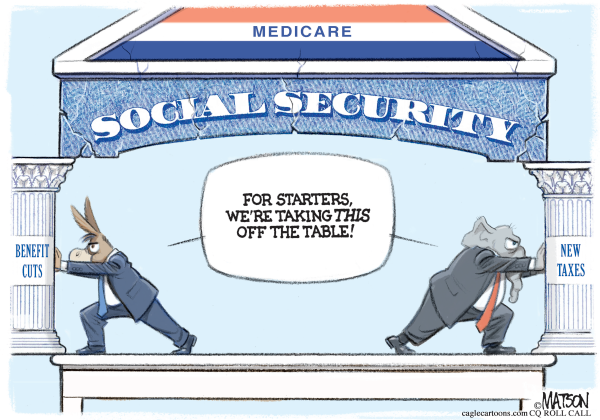

The bill would accomplish this by lifting the cap on the maximum amount of income subject to the Social Security payroll tax—a change that would not raise taxes on the 93% of U.S. households that make $250,000 or less per year, according to an analysis conducted by the Social Security Administration at the request of Sanders.

Currently, annual earnings above $160,200 are not subject to the Social Security payroll tax, which means that millionaires will stop contributing to the program later this month. The legislation proposes lifting this cap and subjecting all income above $250,000 per year to the Social Security payroll tax. If enacted, the bill would have raised more than $3.4 billion from the nation’s top 11 highest-paid CEOs alone in 2021, including $2.9 billion from Tesla and Twitter executive Elon Musk.